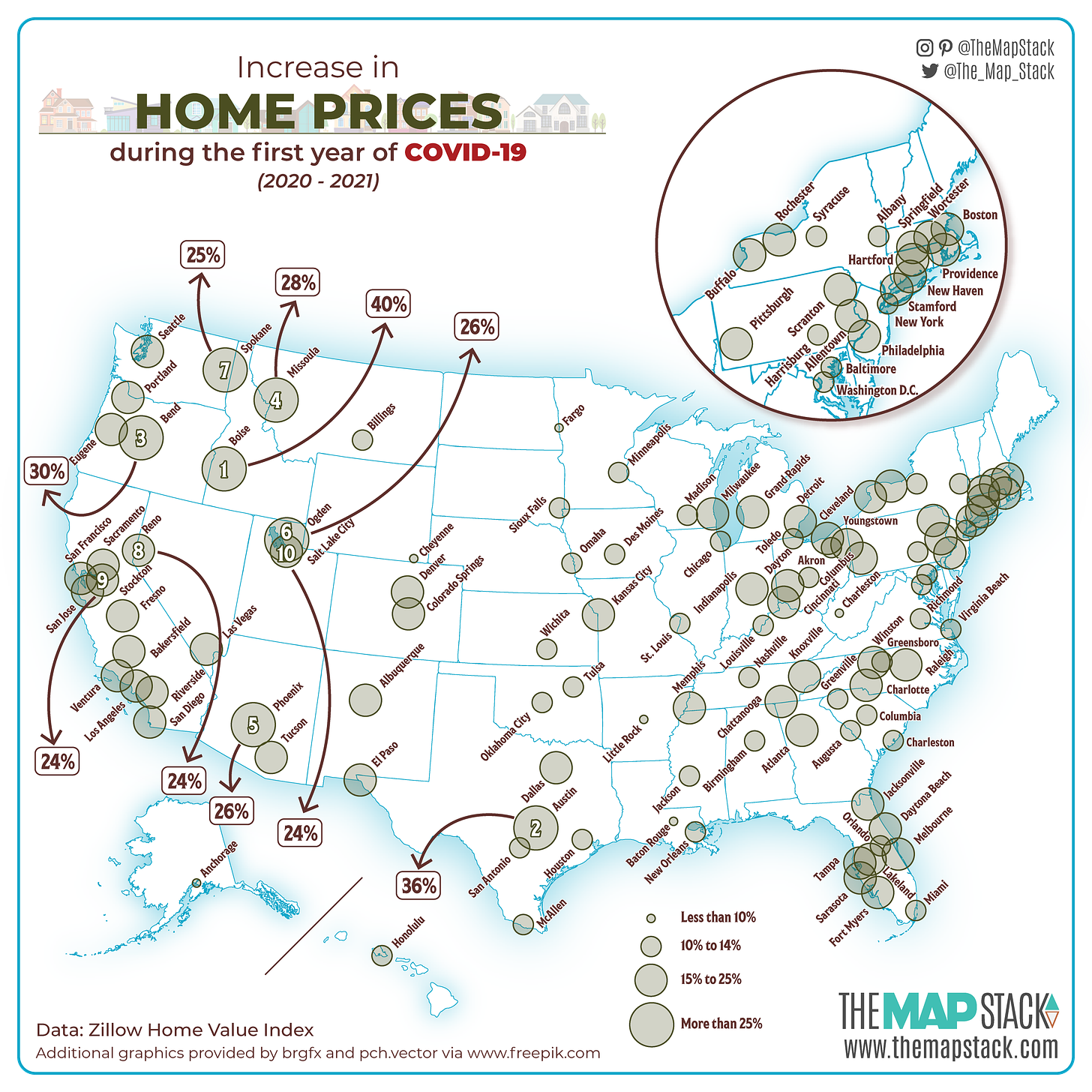

Home prices during the first year of the COVID-19 pandemic exploded. While there was already a nationwide housing crunch, the pandemic really upped the ante. And so-called “second tier” cities performed exceptionally well. Boise’s, Spokane’s, Reno’s, and Stockton’s home prices during the year of the pandemic exploded onto the scene. These are, of course, just examples. Many more small to mid-sized cities’ home prices grew at incredible rates.

While this may all seem like good news, the reality is that many people are now being locked out of buying a home for the foreseeable future. Take Stockton, CA, for example, at an average price of $386,000 in June of 2020, housing prices were fairly modest for being in California. While still expensive for some, it was far more affordable than San Jose or San Francisco, both of which had an average home price of over $1 million in 2020. Other affordable cities across the country saw similar price spikes. Phoenix jumped 26% from $299,000 in June of 2020 to $378,000 in June of 2021. Reno skyrocketed from $392,000 to $489,000.

In a country with a big homeless problem, these numbers are quite scary. Higher home prices often leads to higher rental prices. And higher rental prices typically mean people get priced out of their homes and can end up living on the street. We saw this exact scenario occur on the west coast during the last decade. And now it appears that the same thing may happen across the country.

COVID’s impact on home prices

While we can’t say for certain the pandemic is the primary cause for the jump, it does appear to at least have played a large role. If you take a look at the graph I made below, you’ll see what I mean.

This graph shows the housing price changes for each year from summer 1996 to summer 2021. While we can see a clear upward trend, almost every single city sees a jump between 2020 and 2021. Even Youngtown, OH sees a noticeable increase!

Also shown on this graph is the increase in inflation over the years. Starting at $150,000 in 1996 and rising to just under $257,000 in 2021, inflation simply doesn’t keep up with home prices. That’s not to imply that affordability is matched to inflation, but it serves as a good barometer of what is affordable. At the very least, we can see that more houses have “jumped” the inflation line between 1996 and 2021.

All this is to say that the price of a house in the United States has reached staggering levels. For those that own a home, it’s likely a good thing. For the rest of America, however, it’s a very bad thing. And unfortunately, there’s little on the horizon to correct the market. Oregon recently passed a law to ban single family zoning which means duplexes, triplexes, and fourplexes can now be built on land that was previously exclusive to single detached family homes (the most expensive kind of housing). California and Minneapolis (read: not Minnesota) have made similar inroads. But these are long term solutions for a housing market that needs an immediate fix.